Find answers to all your most frequently asked questions about HUBFX Multicurrency Account.

If you don’t see what you’re looking for and have questions about your existing HUBFX Account, just contact us here.

✅Fees

Our indicative rates are provided by TradingView and take the spot interbank exchange rate. We apply a markup which will be displayed before you confirm the transfer.

The current standard FX transfer rate is charged at 0.50% (excluding market holidays, like weekends and bank holidays).

Speak to your customer sucess team here to understand your rates.

✅Limits

International payments are for:

individual purposes, such as paying for goods, bills, etc.

business purposes, such as payments to suppliers, payments from customers or payroll.

Yes, the following limits apply for each currency account:

- The maximum singular inbound or outbound payment limit is GBP 1,000,000 equivalent via Faster Payment.

- Otherwise, The maximum outbound and inbound limit is GBP 10,000,000 equivalent.

- For large transactions, we adivse to communicate with the customer sucess team here first.

To request a change to your account balance limits, please contact the customer sucess team here.

On our Permitted Countries, there’s a full list of countries you can send money to and/or receive money from: Permitted Juristinctions.

✅Setting Up

Yes. We’ll be adding many more currencies in the future, including BRL, and CNY (for EU Clients), etc. We’ll let you know once we do.

✅Using your IBAN and HUBFX Account

Currently the multi-currency accounts can only be used to send or receive payments, trade FX spot and trade FX forward, and bulk pay payments. We are developing the card functions however we want to make sure we provide quality FX and international payments first. You can use your high street bank card for using the currency balances you have that issued by the bank. When you are abroad using the balances, if you have any, make sure you always select “use local currency” to avoid the fees charged by the merchant’s POS providers.

No. There’s no guarantee your transfer will be directed to us if you’re using an online IBAN generator, it’s very risky and we wouldn’t recommend using this method under any circumstances.

Please login to your account and use the IBAN associated with your Currency Accounts.

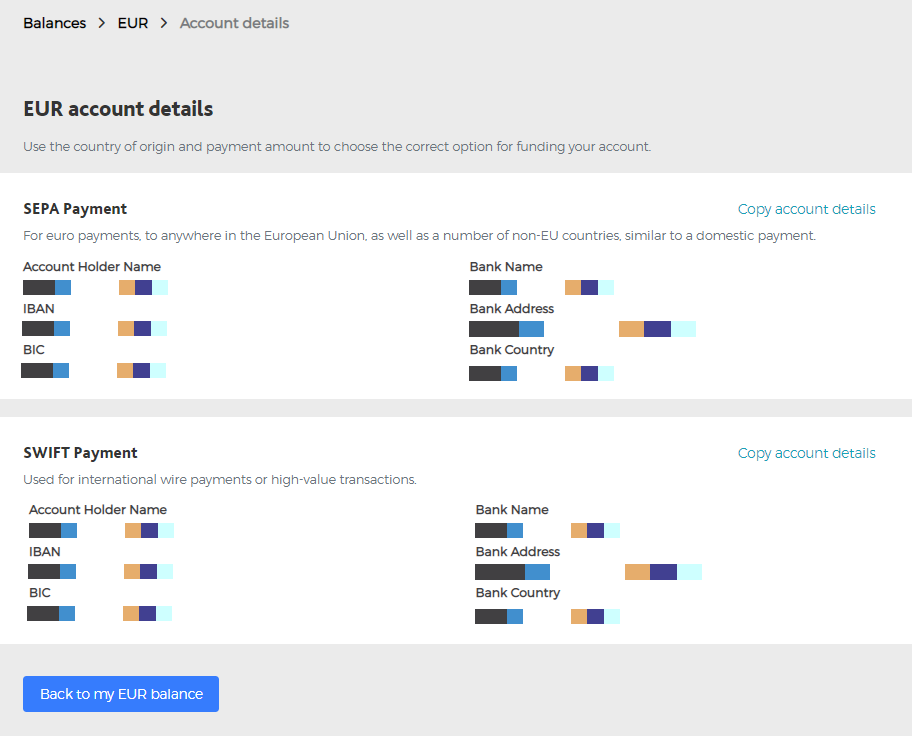

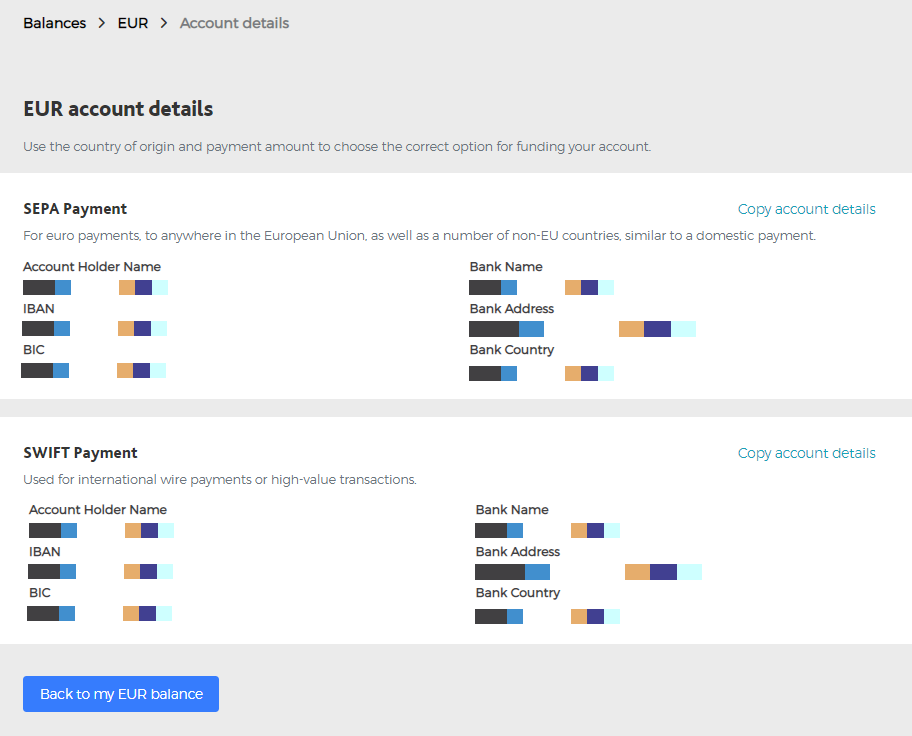

Share the IBAN and BIC associated with your each currency account with the person who wants to pay you. You’ll receive unique IBAN and BIC pairs for each currency account you have with HUBFX once you are registered.

You can find these details in-app by tapping/choosing the Currency, for example, Euro, then choose “Add EUR“, (then “Manual Bank Transfer” for GBP).

You will see:

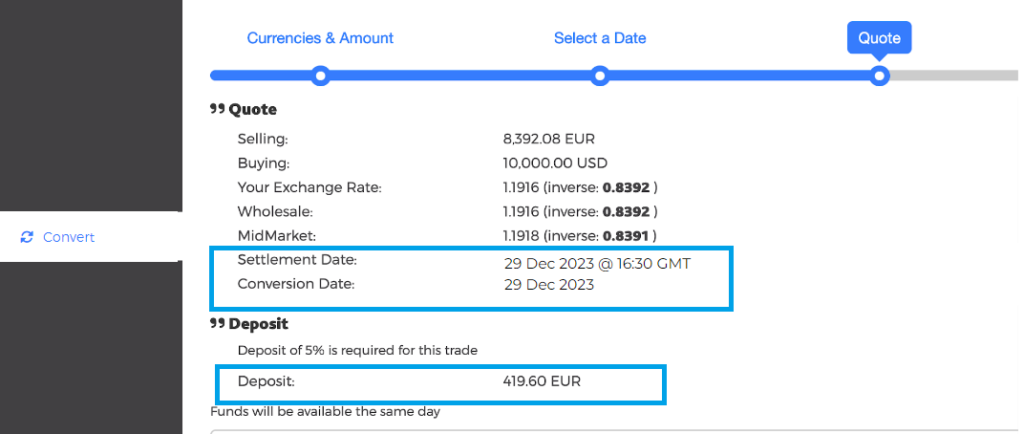

Forward Trade is a trade you book today to pay 5% of the Selling Currency to lock the Buying Currency at today’s rate.

Why would one book a forward trade? / lock a rate?

1. When you have a set budget rate for Calcuating your Selling Currency/Buying Currency rate;

2. When you know a set amount of Money (Buying Currency) in the future date you need (to pay);

3. When you have a monthly or quarterly or yearly financial plan where you have set a reference FX rate that you want to lock in.

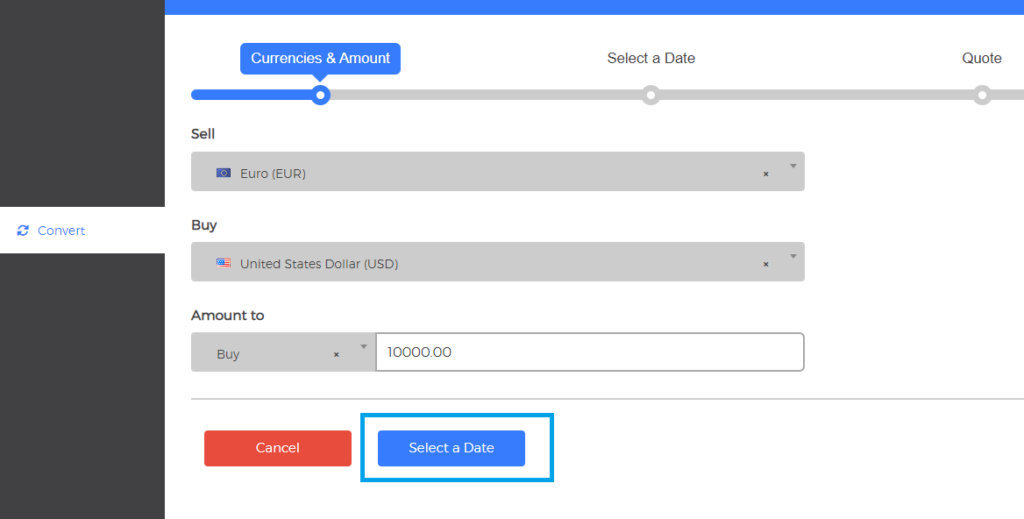

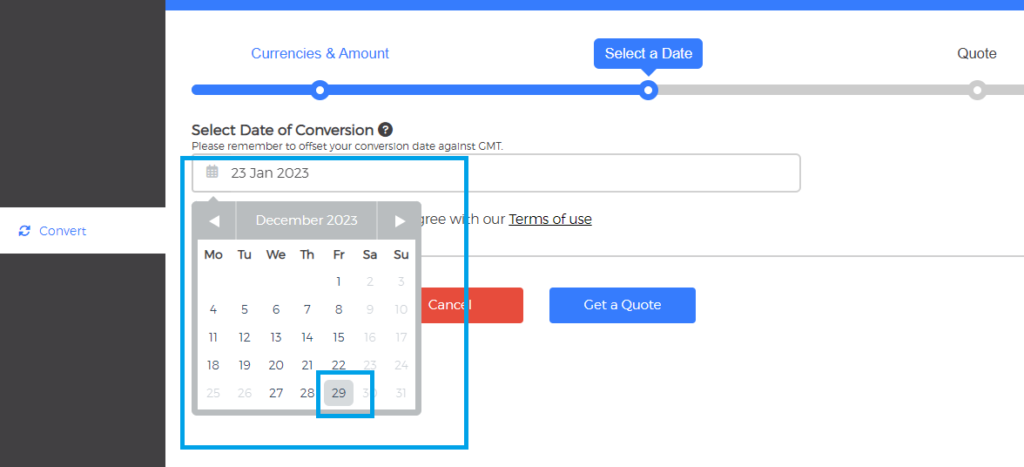

Step by Step Instruction:

(1) Under “Convert”, after you have selected the Selling Currency and the Buying Currency, Sell Amount or Buy Amount, click “Select a Date“:

(2) Unlike Booking a Normal Trade, you don’t make changes to the calendar, instead, you choose a Future Date on the calendar:

(3) You will then be quoted the Future Date Rate and the Deposit you need to pay Today. What you need to pay on Future Date the is the Selling Amount (95%) – Deposit (5%).

Contact us here, and we will close the account on your behalf.

Tap/Click “Convert” in your Webapp, and select the currency you’d like to buy and the currency you’d like to sell. You’ll see the rate before you confirm the transaction, tap/click “I am happy with this quote”, and choose “Convert“. Your balances will be updated.

Just as you’d make any other payment through a Banking App: Tap/Click “Pay” and select which currency you’d like to send money from and enter the amount. You can then add a new recipient and their account details before going ahead to confirm payment.

On our website, there’s a full list of countries you can send money to and/or receive money from: Payment Guides.

There are two ways you can do this: you can either “convert” GBP from an existing GBP account to another currency account, or you can send a payment to one of your IBANs (e.g. send a EUR payment to your GB IBAN to credit your Euro Account).

Payments in EUR (via SEPA) take 1 to 2 working days to arrive. All other international payments (via SWIFT) take 2 to 3 working days.

The payment will be converted into GBP automatically, and deposited into your HUBFX GBP account. All foreign exchange conversions will be executed at our usual FX rate. If you receive a payment from a region or in a currency that’s not currently supported, it will be returned to the sender’s account.

The receiving bank may convert your payment into the new currency before the funds are deposited into the recipient’s account. Unfortunately, we have neither visibility nor control over any charges applied by third parties. However, the recipient can confirm with their bank what fees and conversion rates will be charged.

Contact us here as soon as you can. Our team will work with all the necessary service providers to locate the payment, but unfortunately we can’t guarantee that an incorrect payment will be recovered.

✅Your HUBFX (Multicurrency) Account

Short answer: yes!

HUBFX holds the equivalent of the e-money we create for our members in what we call a Safeguarding account with Barclays Bank. This is a ring-fenced account that can only hold funds for our members e-money relating to our International Currency Accounts feature. No other funds such as fees, HUBFX’s own funds, or any other companies’ funds are allowed in it.

Moreover, the funds in this account can never be loaned out by the credit institutions to other customers and, as such, are not exposed to risk. Because your funds will never be reinvested, they don’t require FSCS protection (which is only required where credit institutions reinvest and take risks with your money).

Bank Account Verification is an additional step in the onboarding process for EU clients.

If you are EU clients then we need to verify your, or their, bank account. This is to comply with an additional regulatory requirement for onboarding to our EU Clients.

How are bank accounts verified?

When a client account is created, payments and transfers are not possible until the client’s bank account is verified. For this, we need to receive a minimum of 1p into the new HUBFX account from an EEA Banking Institution bank account held in the client’s name (“Penny Test”). Once this is done, the account is activated and payments and transfers can be made.

Will I be notified when the bank account verification process is completed?

Completing the verification process triggers a ‘Bank Account Verified’ push notification. Alternatively, clients are welcome to contact customer support to query the status of accounts.Any e-money in supported currency HUBFX creates for the members will have an equivalent amount safeguarded in real money terms in the currency at Barclays Bank. Any e-money HUBFX creates for their members in currencies other than the supported currency will be safeguarded in real money terms in GBP at Barclays Bank and re-adjusted daily based on the exchange rate fluctuations.

We have carefully selected the credit institution that will hold these funds based on a thorough analysis of their financial reports and any adverse media. We regularly review our choices and have accounts in different credit institutions should the financial risks increase at Barclays Bank.

🌎Globalfy Client

Once you are registered, go to your HUBFX Account:

- Tap/Click “Convert” in your Webapp, and select Sell “CAD” and Buy “USD” as well as enter the amount. You’ll see the rate before you confirm the transaction, tap/click “I am happy with this quote”, and choose “Convert”. Your balances will be updated.

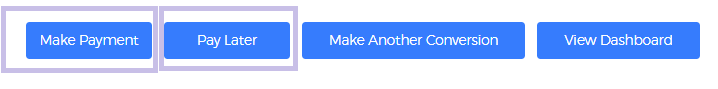

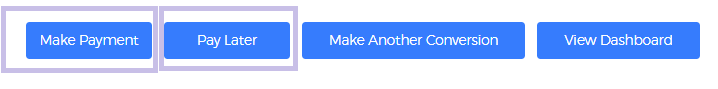

- On the same page, you could either choose to pay the USD you just bought straight away by clicking “Make Payment“, or pay later by clicking “Pay Later“.

Once you are registered, go to your HUBFX Account:

- Tap/Click “Convert” in your Webapp, and select Sell “EUR” and Buy “USD” as well as enter the amount. You’ll see the rate before you confirm the transaction, tap/click “I am happy with this quote”, and choose “Convert”. Your balances will be updated.

- On the same page, you could either choose to pay the USD you just bought straight away by clicking “Make Payment“, or pay later by clicking “Pay Later“.

- Check if we can trade the Currency you have here.

- If we trade the Currency, register an account here.

- Once you are registered, go to your HUBFX Account:

- Tap/Click “Convert” in your Webapp, and select Sell “CAD” and Buy “USD” as well as enter the amount. You’ll see the rate before you confirm the transaction, tap/click “I am happy with this quote”, and choose “Convert”. Your balances will be updated.

- On the same page, you could either choose to pay the USD you just bought straight away by clicking “Make Payment“, or pay later by clicking “Pay Later“.

Once you are registered, go to your HUBFX Account:

- Tap/Click “Convert” in your Webapp, and select Sell “GBP” and Buy “USD” as well as enter the amount. You’ll see the rate before you confirm the transaction, tap/click “I am happy with this quote”, and choose “Convert”. Your balances will be updated.

- On the same page, you could either choose to pay the USD you just bought straight away by clicking “Make Payment“, or pay later by clicking “Pay Later“.

Payments in USD via ACH take 1 to 3 working days to arrive. Payments in USD via Fedwire take 1 to 2 working days to arrive. All other international US Dollar payments (via SWIFT) take 2 to 3 working days.

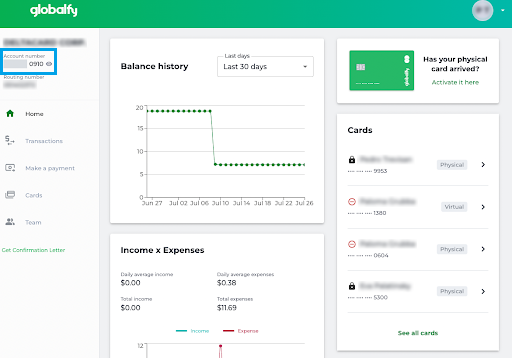

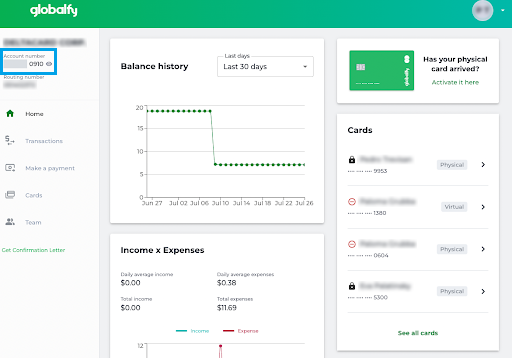

Simply go to the registration page here, quote your globalfy account number. You may find the number on your Globalfy account’s main page, at the top left corner:

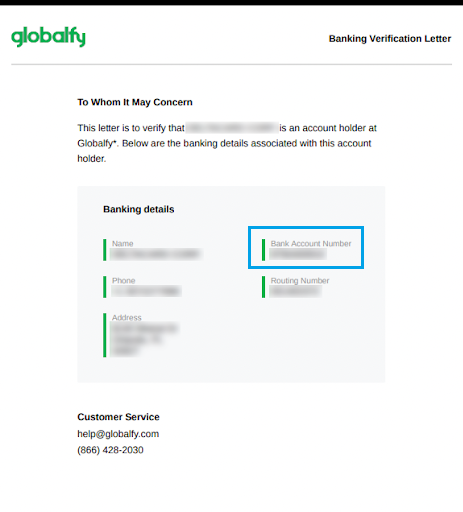

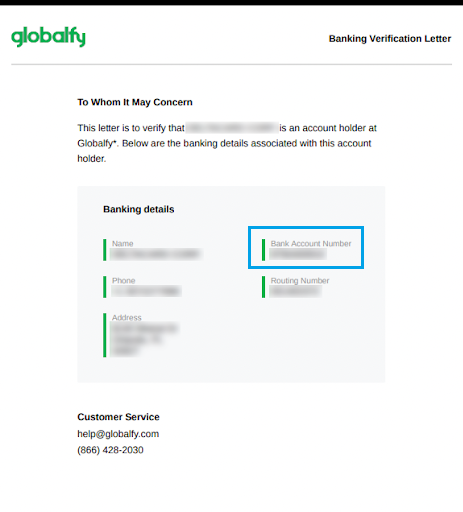

You can also click on Get Confirmation Letter (at the bottom left corner) and you will download a PDF document with your full information, like the example below:

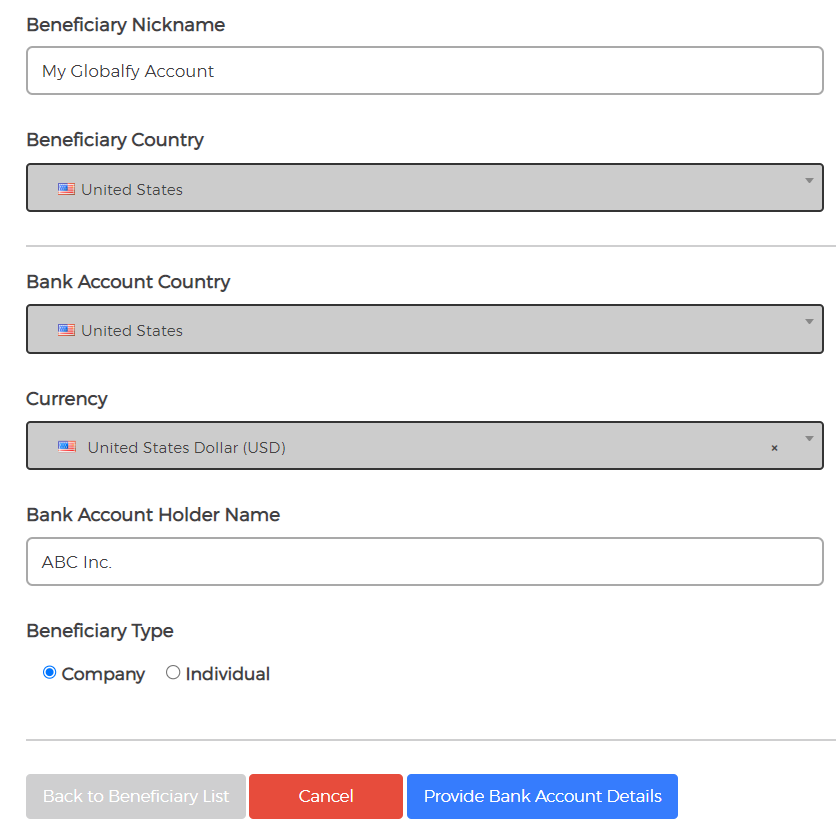

Once you have US dollar ready in your HUBFX Account, go to “Pay” and choose “US Dollar” to pay and enter the Amount. Next, choose a Nickname for the Payee, such as “My Globalfy Account”. And,

Beneficiary Country: United States

Bank Account Country: United States

Currency: United States Dollar (USD)

Bank Account Holder Name: {Your Company Name}

You may find the number on your Globalfy account’s main page, at the top left corner:

You can also click on Get Confirmation Letter (at the bottom left corner) and you will download a PDF document with your full information, like the example below:

You may find the list of currencies here.

Once you are registered, go to your HUBFX account:

- Tap/Click “Balances” in your Webapp, and select “Add a currency“.

- Find the local currency you have, e.g. “EUR“, then “Add EUR“.

- You will then find your EUR account details like this for you to top up: