Streamlining Cross-Border Payments for Ecommerce Success 🌐

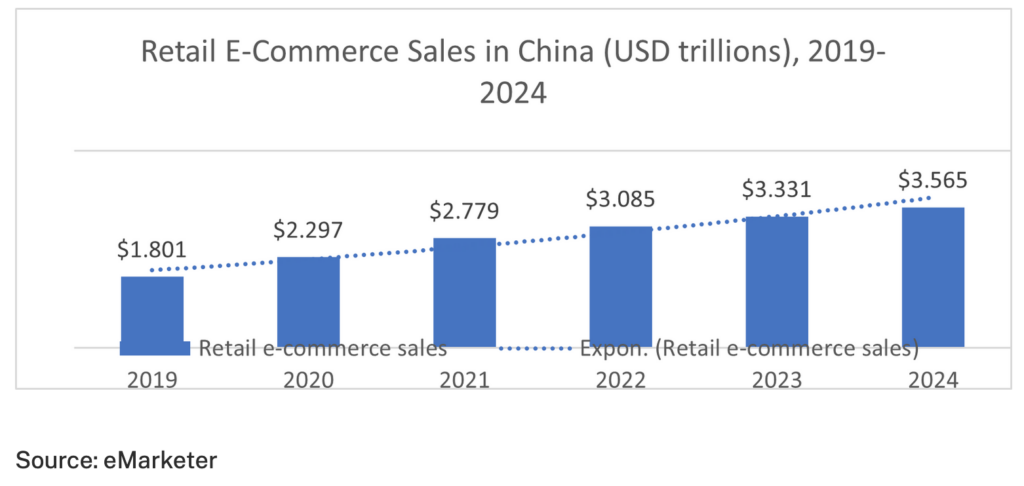

E-commerce is the next frontier of globalisation, with Chinese vendors playing a pivotal role in driving the global digital economy. In 2017 alone, China’s e-commerce exports surged by 41.3 percent to 33.65 billion yuan, marking a significant contribution to the global trade landscape. In 2021, China became the largest market for e-commerce with a revenue of $1.5 trillion, placing it ahead of the United States.

Challenges with Cross-Border Payments into China

Navigating cross-border payments into China presents several hurdles:

- Regulatory Compliance: Chinese suppliers must adhere to stringent documentation requirements set by the State Administration of Foreign Exchange (SAFE).

- Currency Conversion: Suppliers often prefer payments in local currency (CNY), yet payment methods typically default to USD.

- Payment Inefficiencies: Traditional wire transfers result in high costs, risks, and working capital inefficiencies, impacting the entire payment process.

Efficient Payment Solutions in Local Currency

A revolutionary solution now allows e-commerce companies to streamline transactions in local currencies and convert payments to Chinese Yuan/Renminbi (CNY). Leveraging the local clearing system (CNAPS), this approach offers several benefits:

- Cost Efficiency: Reduce payment costs and fees associated with cross-border wires, ensuring vendors receive full payments promptly.

- FX Rate Management: Gain control over currency conversion rates, mitigating FX risks and ensuring fair pricing for goods and services.

- Streamlined Documentation: Simplify regulatory documentation and approval processes, enhancing transparency and efficiency.

- Improved Working Capital: Accelerate access to funds and optimise working capital, fostering stronger cash flow management for Chinese suppliers.

Enhancing Merchant-Supplier Relationships

By adopting cross-border, cross-currency payment solutions, e-commerce platforms can strengthen relationships with Chinese suppliers and enhance the customer experience. This streamlined approach supports broader efforts to create a high-quality, cost-efficient merchant ecosystem.

Key Considerations When Choosing a Provider

When selecting a payment provider, consider the following:

- FX Expertise: Ensure the provider offers onshore FX rates for CNY to minimise costs.

- Security and Compliance: Verify the solution meets data security standards and local regulatory requirements.

- Local Support: Choose a partner with a strong on-the-ground presence in China and expertise in local regulations.

- Innovative Solutions: Partner with a provider committed to continuous innovation and long-term investment in the e-commerce space.

Embrace the opportunities of a globalising e-commerce landscape with streamlined cross-border payment solutions. Choose a provider that offers efficiency, security, and expertise to support your business growth in diverse markets, including China. 🚀

Visit hubfx.co to learn more.