We Respect Your Privacy & Maintain Compliance Standards

We use cookies to enhance your browsing experience, serve personalised ads or content, and analyse our traffic. By clicking "Accept Cookie", you consent to our use of cookies.

We use cookies to help you navigate efficiently and perform certain functions. You will find detailed information about all cookies under each consent category below.

The cookies that are categorized as "Necessary" are stored on your browser as they are essential for enabling the basic functionalities of the site. ...

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

No cookies to display.

Functional cookies help perform certain functionalities like sharing the content of the website on social media platforms, collecting feedback, and other third-party features.

No cookies to display.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

No cookies to display.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

No cookies to display.

Advertisement cookies are used to provide visitors with customized advertisements based on the pages you visited previously and to analyze the effectiveness of the ad campaigns.

No cookies to display.

HUBFX has partners all over the world.

The convergence of financial technology (fintech) and health technology (healthtech) has the potential to revolutionize the healthcare industry by leveraging innovative digital solutions to enhance patient care, streamline administrative processes, and improve overall health outcomes. Here are some potential outcomes when fintech meets healthtech:

Digital Health Payments: Fintech solutions can facilitate seamless and secure digital payments for healthcare services, including telemedicine consultations, prescription medications, and medical equipment. This can enable patients to make convenient online payments, and healthcare providers to receive prompt payment, reducing administrative burdens and improving cash flow for healthcare organizations.

Health Savings and Expense Management: Fintech tools can help individuals manage their healthcare expenses, such as health savings accounts (HSAs) or flexible spending accounts (FSAs), by providing digital platforms for tracking, budgeting, and paying for medical expenses. This can help individuals better plan and manage their healthcare costs, and potentially improve their financial wellness.

Recent Case Study – Working with Globalfy (Google for Startup)

HUBFX has partners all over the world.

The convergence of financial technology (fintech) and health technology (healthtech) has the potential to revolutionize the healthcare industry by leveraging innovative digital solutions to enhance patient care, streamline administrative processes, and improve overall health outcomes. Here are some potential outcomes when fintech meets healthtech:

Digital Health Payments: Fintech solutions can facilitate seamless and secure digital payments for healthcare services, including telemedicine consultations, prescription medications, and medical equipment. This can enable patients to make convenient online payments, and healthcare providers to receive prompt payment, reducing administrative burdens and improving cash flow for healthcare organizations.

Health Savings and Expense Management: Fintech tools can help individuals manage their healthcare expenses, such as health savings accounts (HSAs) or flexible spending accounts (FSAs), by providing digital platforms for tracking, budgeting, and paying for medical expenses. This can help individuals better plan and manage their healthcare costs, and potentially improve their financial wellness.

Patient Financing and Insurance Solutions: Fintech can offer patient financing options, such as medical loans or installment plans, to help patients cover their out-of-pocket healthcare expenses. Additionally, healthtech solutions can integrate with insurance providers to streamline claims processing, eligibility verification, and payment reconciliation, reducing administrative inefficiencies and improving the patient experience.

Digital Health Insurance and Benefits Management: Fintech can enable digital health insurance platforms that offer personalized insurance plans, benefits management, and wellness programs. These solutions can provide individuals with more flexibility and customization in their insurance coverage, while also leveraging healthtech data to offer personalized recommendations and incentives for healthy behaviors.

Data Analytics and Personalized Health Solutions: The convergence of fintech and healthtech can enable advanced data analytics and artificial intelligence (AI) capabilities to analyze health data, financial data, and behavioral patterns to offer personalized health solutions. For example, leveraging financial data, such as spending patterns, can help identify potential health risks, such as unhealthy eating habits or lack of exercise, and offer personalized recommendations to improve health outcomes.

Healthtech Startup Financing: Fintech solutions, such as crowdfunding platforms or digital lending, can provide financing options for healthtech startups to develop and scale innovative healthcare technologies. This can accelerate the development of cutting-edge healthtech solutions and promote innovation in the healthcare industry.

Fraud Prevention and Security: Fintech solutions can also play a crucial role in enhancing fraud prevention and security in the healthtech space. For instance, utilizing blockchain technology can help secure and verify health records, ensure data privacy, and prevent fraud in areas such as medical billing and insurance claims.

HUBFX understands the unique needs of the healthcare industry and has partnered with companies worldwide to offer advanced fintech and healthtech solutions. With our expertise in FX and payment technology, we can help healthcare companies streamline their administrative processes, enhance patient care, and improve overall financial wellness.

Our solutions enable seamless and secure digital payments for healthcare services, including telemedicine consultations, prescription medications, and medical equipment. We also provide digital platforms for tracking, budgeting, and paying for medical expenses, such as health savings accounts and flexible spending accounts. For patients with out-of-pocket expenses, we offer patient financing options like medical loans or installment plans. Additionally, our digital health insurance platforms offer personalized insurance plans, benefits management, and wellness programs.

HUBFX’s advanced data analytics and artificial intelligence capabilities can also analyze health data, financial data, and behavioral patterns to offer personalized health solutions. We understand the importance of fraud prevention and security in the healthtech space, which is why we utilize blockchain technology to secure and verify health records, ensure data privacy, and prevent fraud in areas such as medical billing and insurance claims.

We strive to provide healthcare companies with the most advanced fintech and healthtech solutions to improve patient care, streamline administrative processes, and promote innovation in the healthcare industry.

Currency exchange: HUBFX can help the NHS and its related entities exchange currencies at the best possible rates, which can lead to significant cost savings.

Payment processing: HUBFX can facilitate seamless and secure digital payments for healthcare services, including telemedicine consultations, prescription medications, and medical equipment. This can enable patients to make convenient online payments, and healthcare providers to receive prompt payment, reducing administrative burdens and improving cash flow for healthcare organizations.

Health savings and expense management: HUBFX can help NHS employees and related professionals manage their healthcare expenses, such as health savings accounts (HSAs) or flexible spending accounts (FSAs), by providing digital platforms for tracking, budgeting, and paying for medical expenses. This can help individuals better plan and manage their healthcare costs, and potentially improve their financial wellness.

Patient financing and insurance solutions: HUBFX can offer patient financing options, such as medical loans or installment plans, to help patients cover their out-of-pocket healthcare expenses. Additionally, HUBFX can integrate with insurance providers to streamline claims processing, eligibility verification, and payment reconciliation, reducing administrative inefficiencies and improving the patient experience.

Data analytics and personalized health solutions: HUBFX can enable advanced data analytics and artificial intelligence (AI) capabilities to analyze health data, financial data, and behavioral patterns to offer personalized health solutions. For example, leveraging financial data, such as spending patterns, can help identify potential health risks, such as unhealthy eating habits or lack of exercise, and offer personalized recommendations to improve health outcomes.

Since 2022 HUBFX has joined force with the Google for Startup Company Globalfy to help the clients with setting up and operating businesses globally by providing them a “one stop shop” solution.

Go to Globalfy Client FAQs to find more.

By using us, clients can focus on what they are good at and leave other business and finance tasks to us. Globalfy held the Cross Border Week 2023 in January where industry experts from Amazon Google Shopify Pipefy Aprende Con Wifi VTEX and of course HUBFX have shared their exprience in working in/with companies with the mindset of “borderless” pre-and-post-pendemic.

Since 2022 HUBFX has entered several payment gateways’ schemes, and/or helped clients to enjoy the powerful technology they implemented with HUBFX or our Partners to make their payment management, tresuary management, local & crossborder collections much much much easier than before!

And more to come…

Since 2022 HUBFX has started different programmes and campaigns to support Women in Tech. In our organisation we have Female Professional all cross the UK and the EU region. The mission of the HUBFX FinTech Services is to enable our clients to manage their funds movement seamlessly using the most advanced technology in the world. We work with Currency Cloud, a Visa Solution, the University of York, the University of Reading, and the University of Oxford and many other universities in Europe.

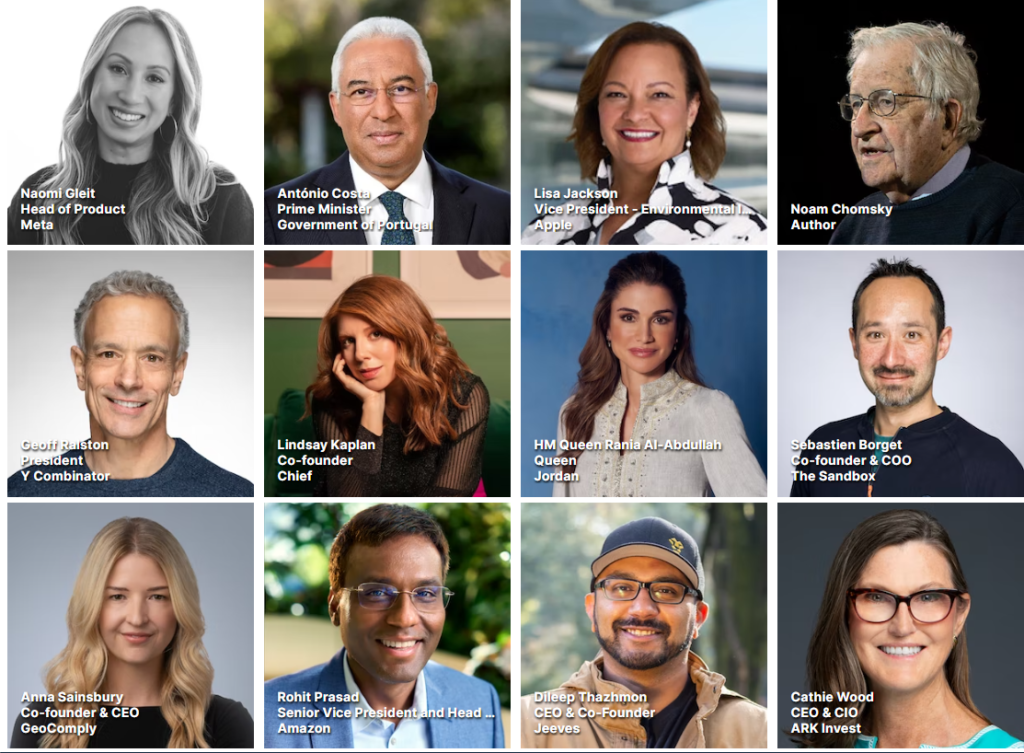

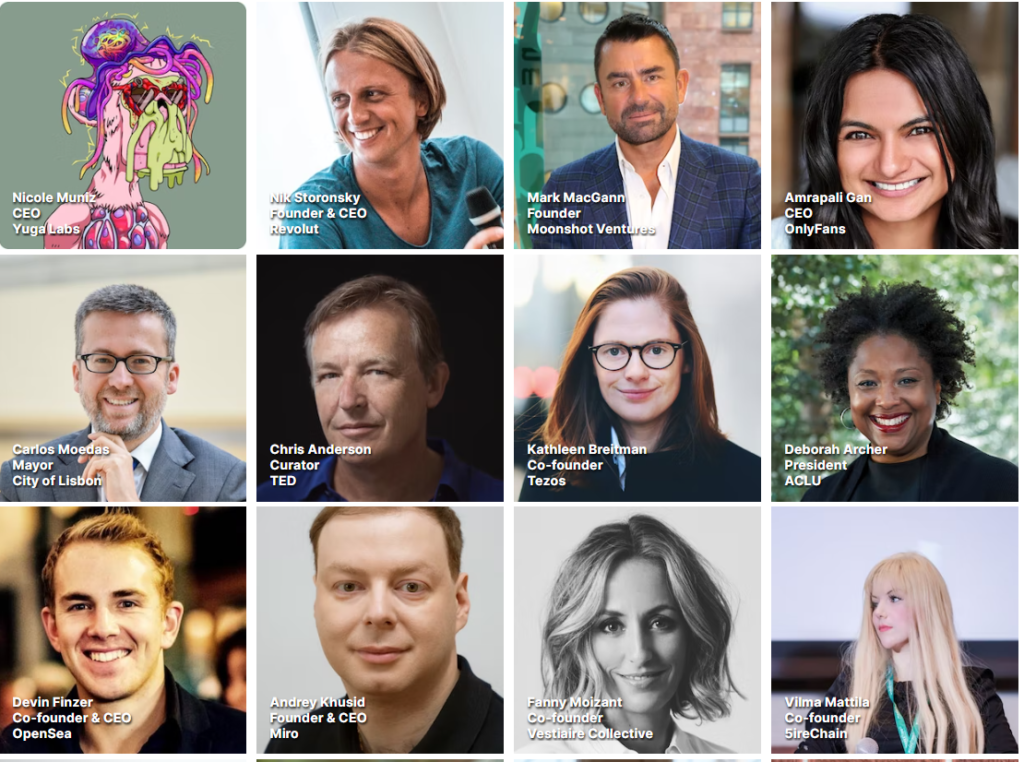

We launched our HUBFX Exchange App in 2022. Meanwhile, we are working closely with Websummit.com to push the products to the next level. Whilst working happily with male and female co-workers. We want to recognise our female partners/friends’ contribution and work by offering them a FREE websummit ticket (worth approx. £900) to encourage more female involvement to the business.

You may find the conference below and enter the draw for getting the ticket by enter your details.

All Communication is Protected and Monitored according to our Compliance and Regulatory Guidelines. Services we provide are regulated by the FCA, the Bank of the Nertherlands, FinCEN, and Fintrac respectively in the UK, EU, US and Canada.

a company from Dublin, Ireland, that holds events across the world: Web Summit in Lisbon, Web Summit Rio in Rio de Janeiro, Collision in Toronto, and RISE in Hong Kong.

Politico has said we run “the world’s premier tech conference”,

the Atlantic that Web Summit is “where the future goes to be born”, and the New York Times that we assemble “a grand conclave of the tech industry’s high priests.”

At a time of great uncertainty for many industries and, indeed, the world itself, we gather the founders and CEOs of technology companies, fast-growing startups, policymakers, and heads of state to ask a simple question: Where to next?

and 900 more industry leaders are coming.

If you are interested in working with us in other subjects, click the contact us now below to send us a message.

If you wish to request for a FREE Websummit ticket, please fill out the form below with a short explanation regarding why you think WebSummit will benefit you. By click submit you agree that we keep your contact details for future events and information about Women in Tech. The winner will be contacted by the end of Wednesday 26th October. If you haven’t received any email from us that means you didn’t get the ticket. However, we will put you on the priority list for the next event! Good Luck!

Thank you all for your interests. After careful consideration, we have decided to choose Jade to be our representitive of the Woman in Tech we choose to attend WebSummit together with us!

Your Profile & Introduction

Your Link 1: /icon

Your Link 2: /icon

Your Link 3: /icon